What Is The Real Estate Transfer Tax In Pa . the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. learn about the pennsylvania real estate transfer tax, including rates, exemptions, and how it impacts your property transactions. Realty transfer tax payments and refund procedure. the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. pennsylvania levies its real estate transfer tax at a rate of 1 percent on the value of real estate (including. The state of pennsylvania receives one.

from www.templateroller.com

learn about the pennsylvania real estate transfer tax, including rates, exemptions, and how it impacts your property transactions. the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. The state of pennsylvania receives one. pennsylvania levies its real estate transfer tax at a rate of 1 percent on the value of real estate (including. the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. Realty transfer tax payments and refund procedure. in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax.

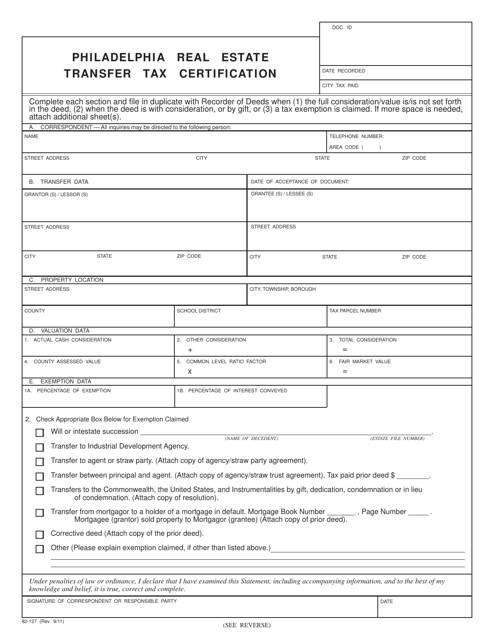

Form 82127 Fill Out, Sign Online and Download Fillable PDF, City of

What Is The Real Estate Transfer Tax In Pa learn about the pennsylvania real estate transfer tax, including rates, exemptions, and how it impacts your property transactions. The state of pennsylvania receives one. the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. learn about the pennsylvania real estate transfer tax, including rates, exemptions, and how it impacts your property transactions. the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. pennsylvania levies its real estate transfer tax at a rate of 1 percent on the value of real estate (including. Realty transfer tax payments and refund procedure.

From dxoluqmio.blob.core.windows.net

Real Estate Transfers Charleston Sc at Michael Hilson blog What Is The Real Estate Transfer Tax In Pa Realty transfer tax payments and refund procedure. pennsylvania levies its real estate transfer tax at a rate of 1 percent on the value of real estate (including. The state of pennsylvania receives one. in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. the pa realty transfer tax is imposed at the. What Is The Real Estate Transfer Tax In Pa.

From www.nber.org

Transfer Taxes and the Real Estate Market NBER What Is The Real Estate Transfer Tax In Pa The state of pennsylvania receives one. pennsylvania levies its real estate transfer tax at a rate of 1 percent on the value of real estate (including. the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. learn about the pennsylvania real estate transfer tax, including. What Is The Real Estate Transfer Tax In Pa.

From moneyqna.com

What You Need to Know about Pennsylvania's Real Estate Transfer Taxes What Is The Real Estate Transfer Tax In Pa the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. Realty transfer tax payments and refund procedure. the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. The state of pennsylvania receives. What Is The Real Estate Transfer Tax In Pa.

From www.mooney4law.com

Explaining Real Estate Pennsylvania Transfer Taxes Mooney & Associates What Is The Real Estate Transfer Tax In Pa the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. Realty transfer tax payments and refund procedure. The state of pennsylvania receives one. pennsylvania levies its real estate transfer tax. What Is The Real Estate Transfer Tax In Pa.

From highswartz.com

Real Estate Transfer Tax in Philadelphia Real Estate Lawyer PA What Is The Real Estate Transfer Tax In Pa Realty transfer tax payments and refund procedure. The state of pennsylvania receives one. learn about the pennsylvania real estate transfer tax, including rates, exemptions, and how it impacts your property transactions. the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. in pennsylvania,. What Is The Real Estate Transfer Tax In Pa.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Los Angeles? What Is The Real Estate Transfer Tax In Pa Realty transfer tax payments and refund procedure. in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. the pennsylvania deed transfer tax (or tax stamp) is one of. What Is The Real Estate Transfer Tax In Pa.

From www.formsbirds.com

Pennsylvania Realty Transfer Tax 8 Free Templates in PDF, Word, Excel What Is The Real Estate Transfer Tax In Pa The state of pennsylvania receives one. the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. the pennsylvania deed transfer tax (or tax stamp) is one of the. What Is The Real Estate Transfer Tax In Pa.

From penncapital-star.com

Pa. House committee votes to eliminate real estate transfer tax for What Is The Real Estate Transfer Tax In Pa in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to. What Is The Real Estate Transfer Tax In Pa.

From anytimeestimate.com

Pennsylvania Deed Transfer Tax (2022 Rates by County) What Is The Real Estate Transfer Tax In Pa the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. Realty transfer tax payments and refund procedure. learn about the pennsylvania. What Is The Real Estate Transfer Tax In Pa.

From exohpdkvo.blob.core.windows.net

How Much Is Real Estate Transfer Tax In Pa at Hazel Patterson blog What Is The Real Estate Transfer Tax In Pa the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. The state of pennsylvania receives one. in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. pennsylvania levies its real estate transfer tax at a rate of 1. What Is The Real Estate Transfer Tax In Pa.

From www.templateroller.com

Form 83T657 Fill Out, Sign Online and Download Fillable PDF, City What Is The Real Estate Transfer Tax In Pa in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. The state of pennsylvania receives one. the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. Realty transfer tax payments and refund procedure. the pa realty transfer tax is imposed. What Is The Real Estate Transfer Tax In Pa.

From help.ltsa.ca

File a Property Transfer Tax Return LTSA Help What Is The Real Estate Transfer Tax In Pa Realty transfer tax payments and refund procedure. pennsylvania levies its real estate transfer tax at a rate of 1 percent on the value of real estate (including. the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. the pennsylvania deed transfer tax (or. What Is The Real Estate Transfer Tax In Pa.

From www.theoldfathergroup.com

Real Estate Transfer Tax What Are They & Where Does The Money Go What Is The Real Estate Transfer Tax In Pa learn about the pennsylvania real estate transfer tax, including rates, exemptions, and how it impacts your property transactions. the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. Realty transfer tax payments and refund procedure. the pa realty transfer tax is imposed at the rate. What Is The Real Estate Transfer Tax In Pa.

From listwithclever.com

Pennsylvania Real Estate Transfer Taxes An InDepth Guide What Is The Real Estate Transfer Tax In Pa pennsylvania levies its real estate transfer tax at a rate of 1 percent on the value of real estate (including. The state of pennsylvania receives one. in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have. What Is The Real Estate Transfer Tax In Pa.

From listwithclever.com

What Are Transfer Taxes? What Is The Real Estate Transfer Tax In Pa The state of pennsylvania receives one. pennsylvania levies its real estate transfer tax at a rate of 1 percent on the value of real estate (including. in pennsylvania, there is a deed transfer tax. consider it a real estate sales tax. learn about the pennsylvania real estate transfer tax, including rates, exemptions, and how it impacts your. What Is The Real Estate Transfer Tax In Pa.

From studylib.net

Pennsylvania Real Estate New Developments in Pennsylvania’s Local What Is The Real Estate Transfer Tax In Pa learn about the pennsylvania real estate transfer tax, including rates, exemptions, and how it impacts your property transactions. the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. The state of pennsylvania receives one. pennsylvania levies its real estate transfer tax at a rate of. What Is The Real Estate Transfer Tax In Pa.

From exohpdkvo.blob.core.windows.net

How Much Is Real Estate Transfer Tax In Pa at Hazel Patterson blog What Is The Real Estate Transfer Tax In Pa the pa realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid, or to be paid, for the. learn about the pennsylvania real estate transfer tax, including rates, exemptions, and how it impacts your property transactions. Realty transfer tax payments and refund procedure. the pennsylvania deed transfer tax (or tax stamp). What Is The Real Estate Transfer Tax In Pa.

From www.therealestategroupphilippines.com

Taxes and Title Transfer Process of Real Estate Properties This 2021 What Is The Real Estate Transfer Tax In Pa the pennsylvania deed transfer tax (or tax stamp) is one of the closing costs you'll have to pay if you're buying a. learn about the pennsylvania real estate transfer tax, including rates, exemptions, and how it impacts your property transactions. Realty transfer tax payments and refund procedure. the pa realty transfer tax is imposed at the rate. What Is The Real Estate Transfer Tax In Pa.